Most informal stock market traders don’t pay too much consideration to the present value of the various different commodities resembling oil, gold and copper, for example. Analysts and brokers like bar charts as a result of they’re an efficient use of information and area. Inventory market analysis isn’t meant for lengthy-term investments as a result of fundamental data regarding a company’s potential for growth will not be taken into account.

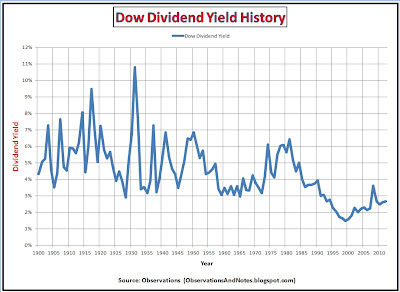

This funding technique has generated long term returns within the inventory market of 10{8267d64a106f8dc6f26ea1c4ef8b0a6d396ccf853f1c860e765a25170ef08209} a 12 months, over the long term, for the past 50+ years. If you wish to spend money on shares and loosen up a bit of, its time to make a fundamental determination in terms of investment strategies.

These patterns will not be actual and accurate answer to everyone’s query if a stock is a purchase or a sell but primarily it guides one to at least know what’s the probable value action of the stock within the next couple of days base on historic value motion.

The fantastic thing about Historic Inventory Costs knowledge is that it enables you to see previous motion and gives you the chance to analyze the knowledge for doable “patterns.” While you discover a predictable pattern within the rise and fall of inventory prices, then you can use that as a information for purchasing and selling stocks.

Subsequently, it is a rare occurrence when inventory costs rise above or beneath the Bollinger Bands. These traders try to buy growth stocks, those who appear almost certainly to continue growing for a long term. You possibly can think of a stocks worth going up as a staircase, it will bounce towards a certain worth and commerce sideways, then it breaks via and trades larger, the previous worth that the inventory had hassle breaking above is now the assist worth.